General Comment

This June we had an anticipated round of holidays, thanks to my wife getting her break this month against the more usual “July/August” period. There are several great points of going to holidays in June.

First of all there are less people around, prices are a bit more decent, less traffic and more opportunities to see things that normally take long queues and stuff like that.

This means that July and August we’ll be stuck working in Florence, but that’s actually good because the city will be empty (most of Italians go on holidays during these months) and Florence will actually be much more beautiful than normally is.

Investment-wise markets have bee relatively calm, the lateral phase where every time we see a potential bullish breakout there is something (usually Trump related) that pushes things back down again.

I am not an advocate of trade tariffs, I think that they are quite dangerous for world’s economy, it’s nothing that can be really controlled by us small investors, but if things start to escalate some negative effects on growth and international companies might be felt soon…

But let’s see what the LH Portfolio did this month!

LH FUND

Explanation of terminology and graphs is HERE.

Let’s see the numbers:

| Month | TR | YTER | NYYoC | Forex |

| 11.15 | 0.00% | 0.00% | 0.00% | 0.00% |

| 12.15 | -3.33% | 1.22% | -0.13% | -1.00% |

| 12.16 | 7.06% | 1.14% | 1.16% | -4.35% |

| 12.17 | 9.94% | 1.04% | 2.64% | -5.94% |

| 1.18 | 9.06% | 1.07% | 2.66% | -7.40% |

| 2.18 | 6.13% | 1.06% | 2.66% | -7.95% |

| 3.18 | 5.85% | 1.04% | 2.81% | -7.21% |

| 4.18 | 9.02% | 1.03% | 2.90% | -6.07% |

| 5.18 | 8.89% | 1.36% | 2.68% | -4.42% |

| 6.18 | 9.16% | 1.35% | 2.65% | -4.91% |

NYYoC is falling (vs. previous month) – What happened this month? In May there were taxes that messed up Yield on Cost, but June? The answer is below, but basically it was a very poor month, options related, as a result yield has been strongly affected. Hopefully this value will start growing again next month.

TR is increasing (vs. previous month) – Total Return is back at higher levels, forex is helping there as the dollar gained strength agains the euro.

Forex is down (vs. previous month) – Weakness in the Euro helps and the gap between my main currency (Euro) and the rest gets smaller. Pound still very weak but until Brexit happens I do not see many changes there…

June 2018 had a very difficult task: trying to get close to 2017 result. It was more of an impossible task so to speak, as in previous years a FIAT bond that I had paid it’s yearly return in June, something around 2800 euro. So getting to last year result without the bond (it expired last year) was quite hard, and the option trades that I made did not help as well…

June closed with a modest 672 Euro result.

Dividends accounted 1513 Euro (-59%% vs.2017) and Options ended up with a -840 Euro (-782% vs 2017).

Neither Dividends nor Options were positive this month, it is probably the worst month ever since inception!

So am I screaming in despair? No actually I am pretty calm. Options result are due to rolling of some positions that were badly in the money (for the people who don’t know options let’s say that the trade was heavily against me). By managing the trade I get to lose money this month, but hopefully I will be able to recoup this loss at a later date during this year. Dividends performed well, if we take away the FIAT bond payment from 2017 there is a pretty strong increase.

None to report

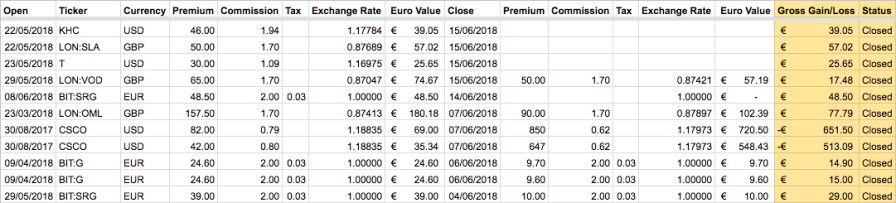

New Positions – Sold Positions

Sold 1000 LON:OML @ 2.17 GBP

I actually loved Old Mutual, insurance stock + asset manager from South Africa, but floated in UK. Problem is that the company decided to split in 4 different units and make a whole sort of corporate actions that I could not understand very well, and since keeping the stock would have meant being a future owner of a bunch of companies that I did not want, including a lot of tax related issues that you get when these demergers happen, I have decided to kill the position with a small profit.

Bought 1000 LON:SLA @ 3.7 GBP

Standard Life Aberdeen is a company that resulted from the merger of Standard Life (Insurer) and Aberdeen (Asset Manager), they created one of the biggest Asset Managers in the world. I sold a put option and I let it expire, the price seemed right at the time but it fell more than 10% since assignment. No big worries, I think that the group is very interesting and they have a good potential to do well, once the merger goes up to speed.

Options Plays

Nothing to report

Conclusions

June was a rather bad month, results that “matter” for the portfolio (Yield mostly) went down, and both Dividend and Options did not grow vs. last year. It was all “foreseen” and therefore I can say that I am not too worried about what happened.

I am having difficulties at selling Covered Calls, following my strategy, this means that after the fall the market did not recover at previous levels, but dividends keep on coming so no bi worries there, the second half of the year might prove good to close off some of the very big dinosaurs that are pestering my options yard, I’ll be happy when they are gone as they are blocking quite a bit of spare cash.

I started reading some odd article here and there talking about Aristocrats and how they will lose a lot when rates go up. Of course this is a concern, but I strongly disagree with people comparing bonds to dividend paying companies, the instruments are so different one from the other… Brexit is also a concern, I might start reducing 100% UK reliant companies (if I can) because so far no news are coming out and to me this is not a great sign.