General Comment

General Comment

July has just finished and “strangely” I have all dividend payments already in the bank, this means an earlier update. July passed away really quickly, I think that this is because of my current unemployed status which leaves me a lot of free time that tends to fly rather quickly. I am finally following a lot of things that I could not follow before, all in all I am really happy with the decision that I have taken, we need to see what the future holds but I am positive about it. Economically the biggest piece of news is the collapse of the Dollar against the Euro. Media is blaming the Trump administration that is casting shadows of uncertainty on the US, I guess that there are other forces at play (one could be that European stocks have less “lofty” evaluations than their US counterparts), rates are going to start rising in the Eurozone soon… As to me I am not particularly worried about the exchange rate, it’s a good opportunity to buy at a discount for us Europeans 🙂

LH FUND

The “Long Haul Fund” is my attempt of getting an “immediate” state of the art of all the investments that I am following. Pretty much like professionally managed funds I can boil all the activity down to a performance indicator, in our case Total Return. (Thanks to Dividend Life for this post on how to create a Fund)

TR stands for Total Return (selling everything, paying taxes and commissions and converting to euro), YoC is Yield on Cost (what my investments have returned to me via dividends/options), TER is Total Expense Ratio (commissions + taxes).

Total Return is not something I am particularly concerned about at this stage (plus it’s an estimate as I have calculated potential taxes and commissions in it), it’s highly affected by the way the market behaves especially in a young portfolio such as this one. But it’s a metric that it’s worth keeping an eye on. YoC is on the other hand more interesting to me, as that is what the PF has produced over time, my target is to reach the 2% x year net mark (by net I mean YoC-TER).

| Month | TR | TER | YoC |

| 11.15 | 0.00% | 0.00% | 0.00% |

| 12.15 | -3.33% | 1.27% | 1.13% |

| 12.16 | 7.06% | 2.34% | 4.75% |

| 1.17 | 4.76% | 2.38% | 4.93% |

| 2.17 | 7.26% | 2.53% | 5.30% |

| 3.17 | 8.15% | 2.57% | 5.82% |

| 4.17 | 7.82% | 2.65% | 6.36% |

| 5.17 | 7.59% | 2.84% | 7.21% |

| 6.17 | 6.96% | 2.89% | 8.51% |

| 7.17 | 6.62% | 2.96% | 9.17% |

TR ratio keeps it’s fall since May, third decrease in a row. On top of the devaluation of the Dollar that I mentioned above I have had the total collapse of Carillion in the UK and STX in the US hitting me, Nothing that gets me worried but it’s not all flowers and roses out there.

Options Yield goes to 7.42% (+0.83% vs June), while Dividend Yield goes to 8.69% (+0.39% vs. June). July was a good month for Options (see later), and I might have to work on the formula to calculate the options yield, I might have some updates on that soon because I think that I am underestimating returns. Dividends saw a pretty good growth too, all is on track.

After the June move TER is lying ow again (luckily). There might be some jumps in coming months here because I intend to clean the UK portfolio a bit, and that normally comes at a rather high expense…

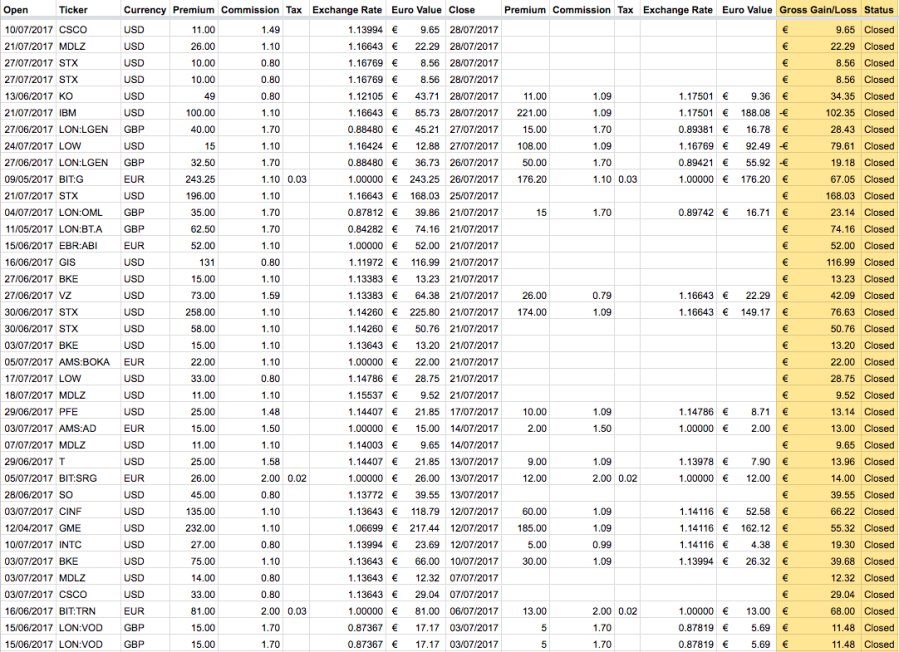

Retreating from the feasts of 4K earnings last month, July scored a very respectable 1858 Euro turnover.

Dividends were 731.64 Euro (+ 36,5% vs.2016) and Options scored a 1126.41 Euro (+1061% vs 2016). Option result is the second best ever (only by 10 euro), so I cannot complain, but it has to be said that the proceeds of the sales of the bond from last month have gone straight into options so an increase in income is to be expected.

Generally speaking I can see that Option income is highly affected by how aggressive you sell strikes, many rolls can contribute to a negative month. This is why I might be changing the strategy on some options selling longer Covered Call strikes on core stocks.

GE – Bought 45 shares @ 25.80 USD

Needed to start trading Covered Calls, GE is under pressure in a very strong way, but 100 shares unlock potential extra gains from selling covered calls, plus I believe that the company can start changing into something more modern and more performant since the old CEO has stepped down.

New Positions – Sold Positions

LON:SSE – Bought 150 share @ 14.50 GBP

SSE is one of the major utilities in the UK. This is a pure “dividend move”, they were going exdiv the day after my acquisition, very defensive, SSE has important level of debts, but also a very good consumer base. It’s the biggest renewable energy producer in the UK, great network but needs to work on customer retention.

SBUX – Bought 100 shares @ 55 USD

Nothing much to say about them, I wanted them at 52, but I have been waiting far too long, so I have decided to move in. Starbucks is a great company with great managers, new “core” holding of the portfolio despite the risible dividend yield.

Options Plays

None to report this month, I have a few active that are likely to be closed in August.

Conclusions

I have had a very long discussion with a bank manager from whom I will be taking some funds to another bank and will be closing my positions. Of course he was not happy and he tried to convince me that he did a great job and so on. The reality is that the funds that I bought through his advice did very well only in the last 6 months, thanks to the Trup Rally. When I told him about my tracker and the strategy that I follow the reply was mixed with scorn and defiance “oh well if you like to invest directly as a game that’s fine, but you can never beat the professionals”… How many times did I hear this in my investing life? I replied that I know perfectly well where my investments are taking me, while I do not know how a certain fund will behave as I do not have control on what they buy, plus I am not interested in total returns NOW, I might be interested later. He wouldn’t take any of that of course, but I did not change my mind.

Why am I telling you this? Well, the path to investing independently is ridden with things like these. Some come from professionals, some come from friends and family. I have a target in my head (generate a stable NET return of 2% per year within the end of 2017), and that’s what I am aiming at. Clearly I do not invest to lose money, so total returns and portfolio performance are important.

Bottom line is trying to stick to the plan, I am sure that there are better investments and investors out there, but as long as I get what I want I will never turn to others to manage my money anymore. Freedom of selling everything and send the cash tomorrow doesn’t have a price in my opinion…

Great update. You made some serious income from options. Nothing like a 1000% increase! Keep it up.

LikeLike

Ciao IH,

The comparison it’s a bit unfair because July was the second month in which I traded options, and the capital deployed was somewhat small. This is actually a bit of an issue for me because every month my capital is changing and it’s really difficult to have a n Annual ROI calculated on the option trades. Anyhow no complaints over the results, those are real, if I could keep it up like that (1K a month) I’d be a VERY HAPPY bunny… 🙂

cia ociao

Stal

LikeLike

Ciao Stal,

Looks like you have had a very good increase in the income this month – keeping a 1k income a month through passive would be a fabulous result…. but the income you are getting through all of these has to be a major help!

Cheers,

FiL

LikeLike

Ciao FIL,

Glad to have you onboard!! 🙂 Yes 1K a month is a target for me this year, and so far I am well ahead of it if all stays like that. It’s nothing “stellar” but as I wrote in other posts and here, it’s what I am happy with, I am not racing to be the smarter/better trader out there. I think that from 2018 the time will be ready to start pushing some limits and set bolder targets, but for now it’s good like this 🙂

Thanks for stopping by!

Ciao ciao

Stal

LikeLike

Ciao Stal,

Far better to build up a solid reliable base before pushing on as it will help prepare you and get things set for the future – good luck, and I will watch with interest!

Cheers,

FiL

LikeLike

Ciao FIL,

Well that’s the plan for my portfolio, I am not after huge returns, but a more stable base to create a steady monthly income. At the end of this year it will be 3 years since inception and apart from some minor issues I’d say that the PF will have reached a point from with the growth that you see this year will be a nice memory, and returns will stabilise. The real “game” starts in 2018 🙂

Ciao ciao

Stal

LikeLiked by 1 person

Hi Stalflare,

This is the first time that I write on your blog but I follow it since 2016. Good job with dividends and shares; I have just one quick question regarding options. Which is your strategy? I mean…do you sell call/put or do you also buy options to sell them at higher prices? I have seen the sheet but I can’t understand what is your way to operate. Could you please explain me in a few words? Do you use technical analysis looking charts or just a fundamental approach? Or probably do you combine the two strategies…

Thanks a lot and sorry for my basic english!!

Andrea

LikeLike

Ciao Andrea,

First of all thanks for stopping by and for following my blog, I love it when “silent” followers decide to write to me 🙂 The strategy with options has been modified quite strongly during the past year, at the beginning of my investment I did not use them at all, I have added them in June 2016 as a supplement of dividend income. At that time I was selling 2 standard deviations away from the money, to keep things safe and was investing only what was leftover in the account from the buying activity. After 1 year and with markets so high I started to have more cash in hand, so I started looking for stocks that were near the 52wk lows. Mind you, all stocks must be dividend payers with a very good track record of dividends. For these stocks I would sell put Near the Money and in case of assignment I would start selling calls NTM to get the stock off the portfolio. I have a shortlist of companies that serve this purpose and I monitor the ones that are paying dividends in the following days/weeks, so that I keep the trade short and if it goes bad I get immediately the dividend. On these stocks I use MACD (3 monts/26 days), RSI, EMA 200/50, BBands and a little of technical analysis on resistances and supports.

I also do “Dividend plays”, where I buy a stock prior to ex-div and sell a call at the immediate next expiration to trap the dividend and get some capital gain, in my report there is an account on how it’s going, so far I never managed to do it “properly” (be in and out in 2/3 days), but results are quite ok for me.

For “core” stocks I am starting to develop a “long call” strategy, where I sell 1 year in the future at 20% prices above my average price, trying to get at least 1 dividend amount with premium. This is because these stocks I really do not want to let go, but in case it grows by 20% in 1 year I might consider selling it (or roll if I really want to keep it).

With some stocks I sell STRANGLES (especially the UK ones), when price is close to my average, or in the -5%/-10% area. I use puts to lower my average price too of course.

I don’t buy options, at least I haven’t tried yet… Write me in private if you like (in Italian of course), we also have a little group on Facebook where we discuss European options and strategies, if you like you can join it!

Ciao and thanks again for stopping by!

Stal

LikeLike

Hi Stal,

Looks like a good month to me and it’s nice to see the PF share price ticking upwards again.

It seems a good move to get away from the managed account and reduce overall fees as well as have more flexibility and control. Your bank manager’s response is expected but a little ironic considering that many professionals don’t beat the market when they’re ‘playing’ with your money.

Best wishes,

-DL

LikeLike

Ciao DL,

The ticking up is actually happening “now” as the graph that you see is updated to the latest data I feed it. As to the account manager I wish I was “quicker on my feet” when replying to these people, of course they are trained to manage people like me and objections like mine, so they always find a way to flip the argument a way or another. I guess that managing these people has always been the hardest part for me, that is why over the years I am starting to be very ruthless and quick when talking to them, no frills, no chances to start talking about what they do and how they do it…

Ciao Ciao

Stal

LikeLike

Hey Stal,

great results – i like your purchase of Starbucks a lot. I missed out on them years ago while they opened coffee shop after coffee shop all over the world. Maybe i get a second chance after their recent price drop. SBUX is a great business with great margins and they will stick around. I would like them even better if they had a little higher yield…but the dividend growth rate is very good.

Best Regards,

DividendSolutions

LikeLike

Ciao DS,

Thanks for posting! 🙂 SBUX had a similar history for me, where I waited and waited for the “right time” to jump in and I never managed to get the stock. This time, although my target was 52 I’ve decided to buy them anyhow! Dividends might come in the future, but I am happy with the company and their expansion plan, in this case yield is quite disappointing but who knows what it might get up to in 3 years!

Ciao ciao

Stal

LikeLike

ciao Stal,

Very good result again 🙂 congratulations!

i like your text in the conclusion.

some weeks ago I was speaking with a man who works in the bank near my home. I want to take a credit for a new home.

He was asking if I have some stocks or something like that. I answer was yes, but i dont want to leave it as security for the credit.

Later he gave me the “advice” that i should stop to buy and sell stocks on my own. its too risky!! 😉

In this situations, i have to laugh about this people, because they dont know anything about me and my strategy. they also dont know anything about the stock market.

so, keep up your great work !

best regards

Chri

LikeLike

Ciao Chri,

Actually I should have laughed as well, and I am learning to let these “incidents” go away… They are used to a public that is not very knowledgeable on investments as a whole and this is their key to get money under management. I remember that during the discussion with the promoter I mentioned that the last 8/9 months have been quite good for the stock markets (Trump rally and the likes), so the stellar results of the funds that he sold me are nothing but normal to me… He said that the rally was in my mind and that actually markets have been quite difficult. I decided to stop arguing at this point… 😀

Thanks for the encouragement!

ciao caio

Stal

LikeLike

Nice update. Glad to read that you enjoy life right now.

life is personal and we need to make our own calls on what we want and what we do not want. going for FI is not the most easy path, and not everybody will understand what we do. Like you say: ignore or laugh at it.

LikeLike

Ciao ATL,

Yes, in my older post that’s what I was trying to “push forward” with the decision of quitting the day to day job thing. I cannot complain about the outcome so far, although September and October are going to be harder months to test my resolute as now in Italy everyone is on holiday and it feels that I am on holiday too! But as I wrote before I am moving my pieces in order to be “busy” from september, so let’s see how that goes! Ciao ciao

Stal

LikeLike

I look forward to read your teaching experiences!

LikeLike

Which reminds me that I really need to start working on the course at the end of the month!! 🙂

LikeLike

Sorry to spoil the holidays!

LikeLiked by 1 person